Back to solution list

Accounting and finance

Simplify your business accounting

Automatic billing and document control.

Creation of own economic analyses.

Comprehensive overview of expected income and expenses.

On-line communication with banks.

Registration and depreciation of long-term and small assets.

Accounting is the foundation of every ERP system

Accountants on the K2 Accounting module especially appreciate the interconnectedness of documents, the possibility of correcting documents that have already been booked; or simply creating your own economic analyzes – whether by centers or other axes. You always see everything important in one single, intuitive system.

The Accounting and Finance module will simplify the accounting of documents. It also allows you to easily create your own evaluations and provides tools for effective financial management.

Jarmila Šarmanová, head of the development team for the economy

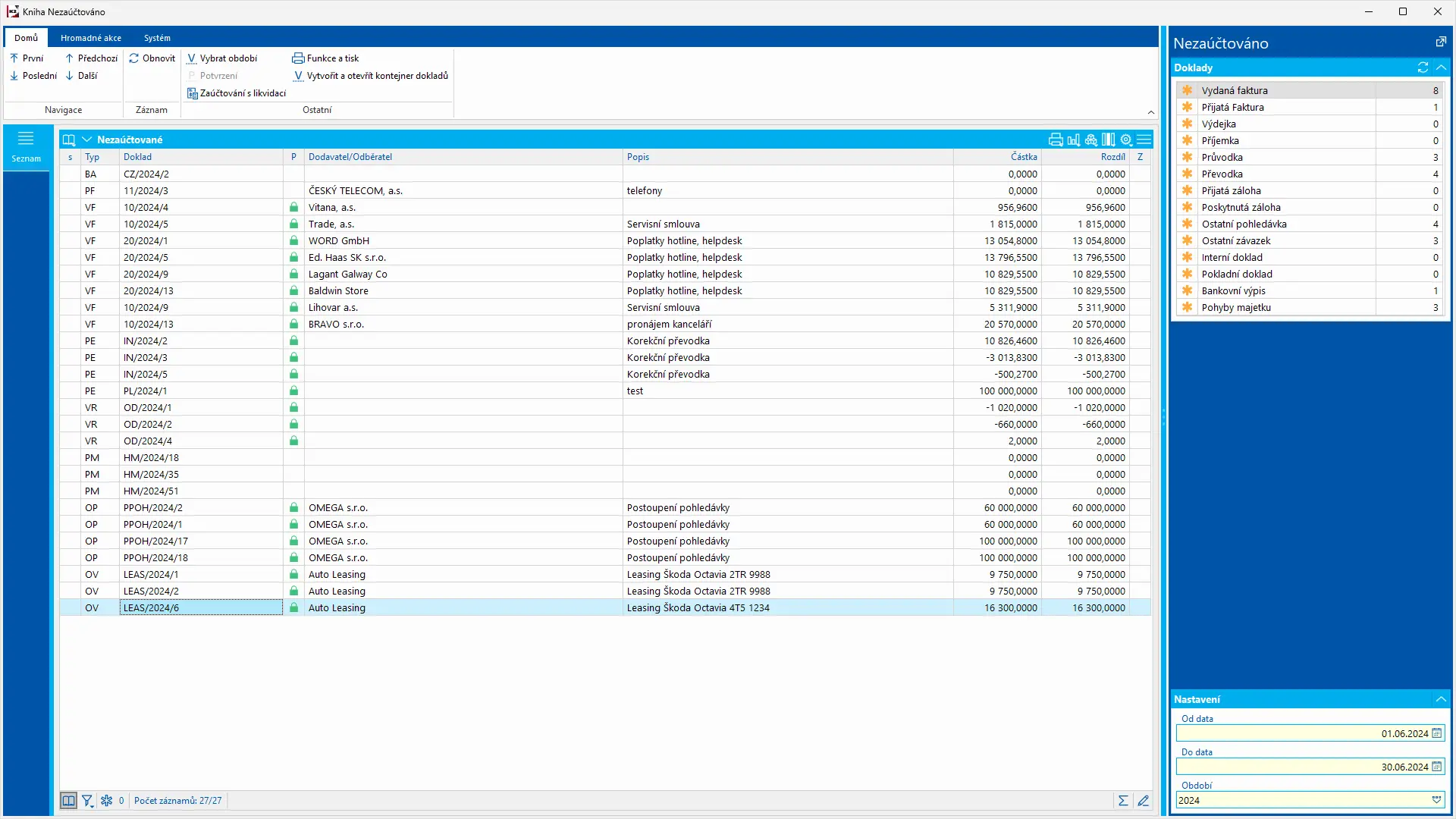

Corrections and checks of documents

The K2 information system allows any number of corrections, as long as the accounting period is not closed. Emphasis is also placed on multiple checks – from matching to posting checks to cross-checks. And that includes permanent monitoring of additional interventions and repairs, which the K2 system immediately signals using the symbols of the selected operation.

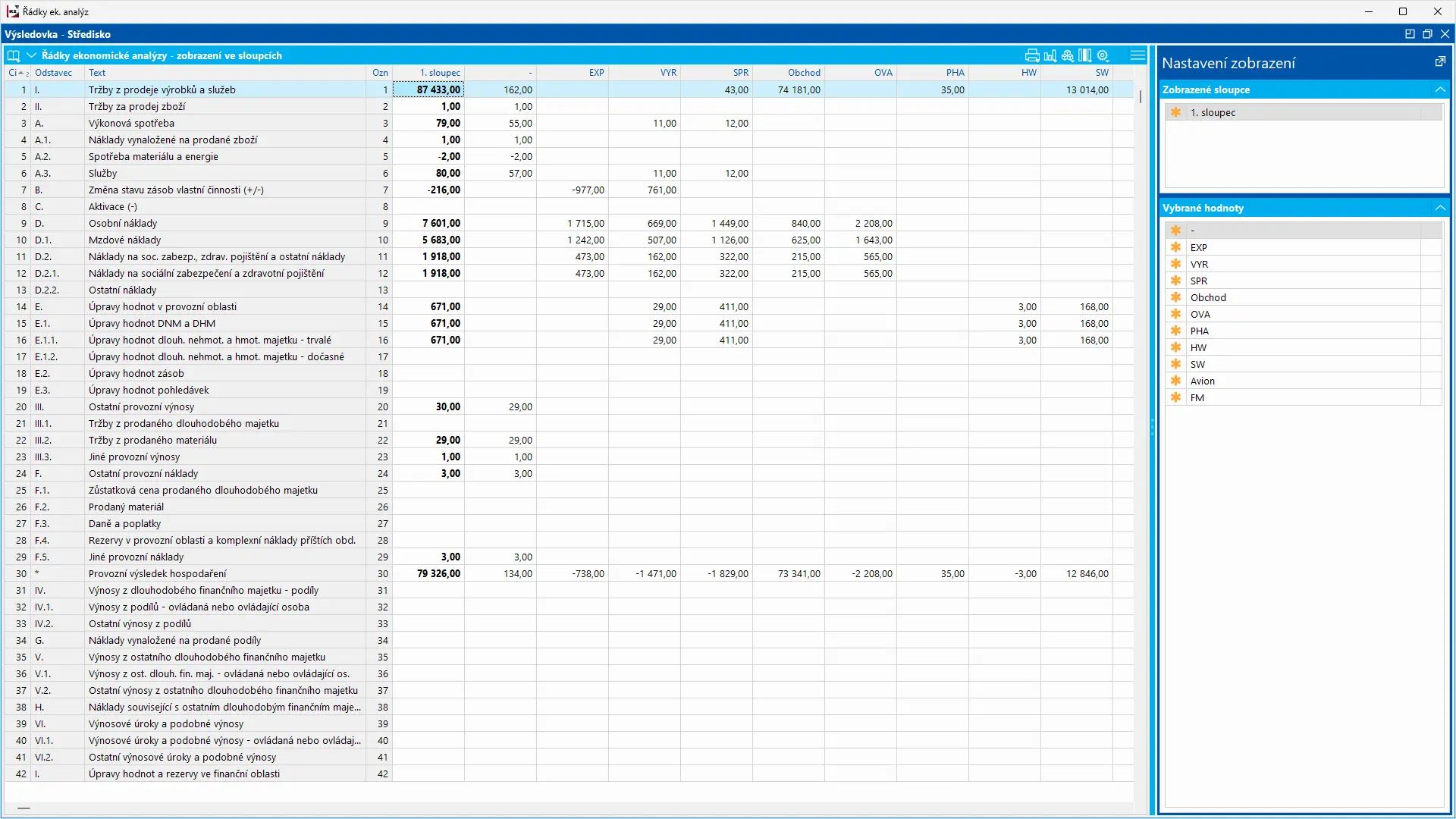

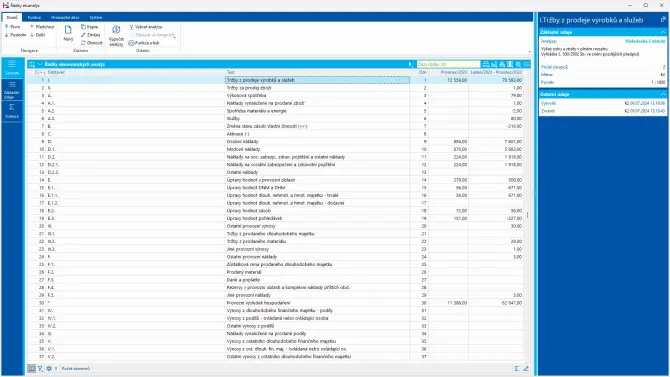

Economic analyses

A powerful analytical tool is the direct connection of individual accounts and economic analyzes to the data warehouse. It is thus possible to evaluate turnover on accounts via any axis (e.g. centers, order codes, periods, currencies and others). It also includes economic analyzes required by our legislation (Balance Sheet, Income statement and others). And it is possible to create other custom analyses.

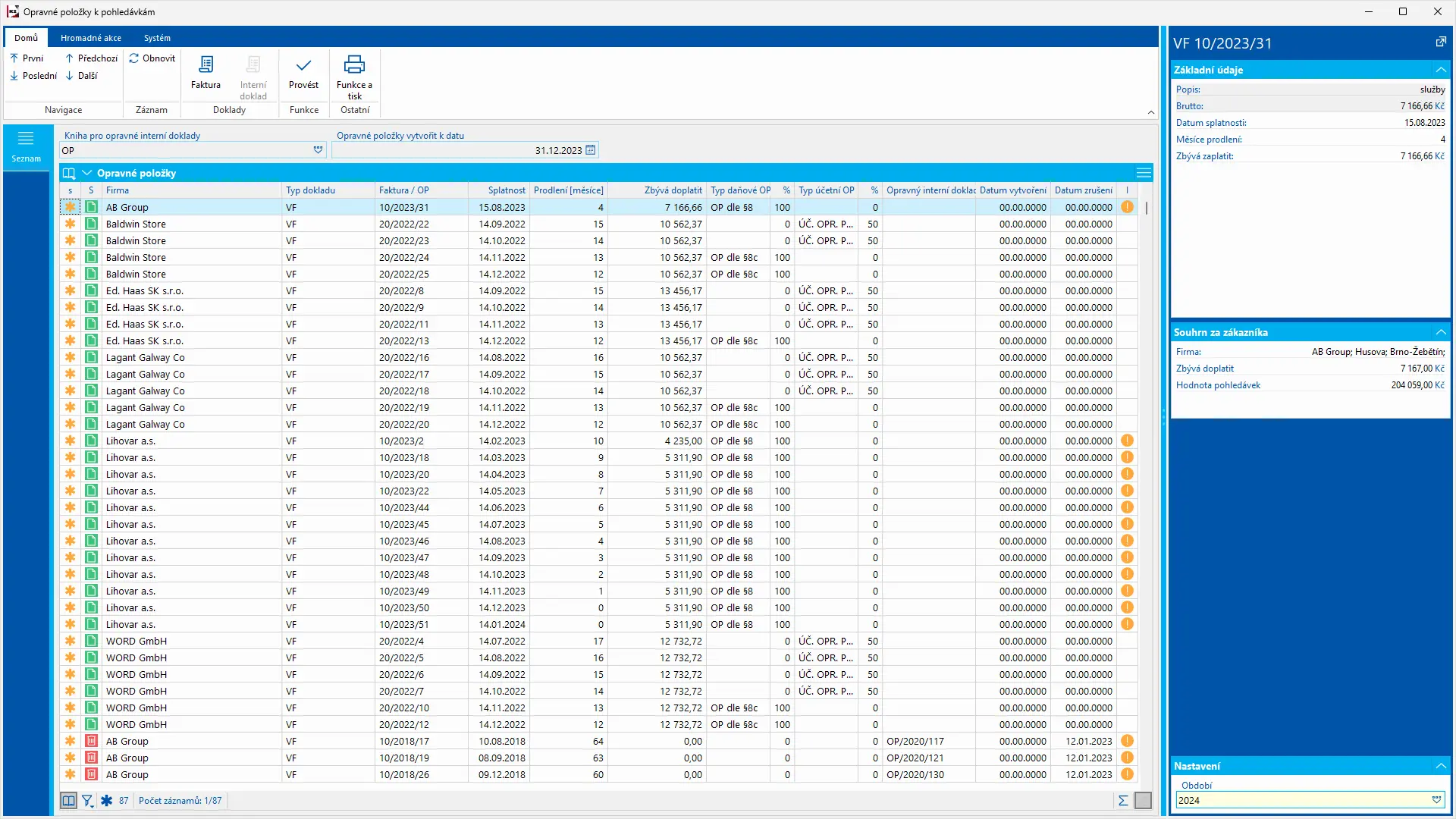

Adjustments to receivables

In K2, the Adjustment items for receivables function is available, which can be used to create adjustment items for invoices issued and for other receivables. K2 automatically presets the appropriate types and percentage rates for tax and accounting adjustments. The user has the option to modify these values. At the same time, the program monitors already existing documents with correction items and warns about changes in the delay, or warns about exceeding the limit for the statute of limitations of the claim.

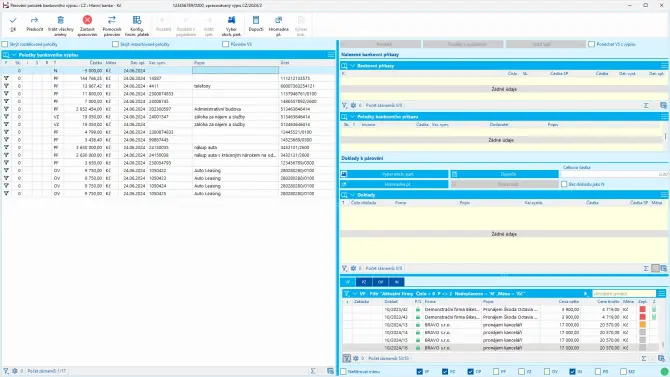

Communication with banks

The system enables the management of any number of bank accounts and cash registers in different currencies. Communication with banks takes place via home banking, for all banking institutions operating in the Czech Republic. Through bank statements, invoice payments can be registered without the need to post them, which guarantees an immediate overview of the payment of individual invoices and the status of receivables and payables. The statements of selected banks can also be downloaded online using the API.

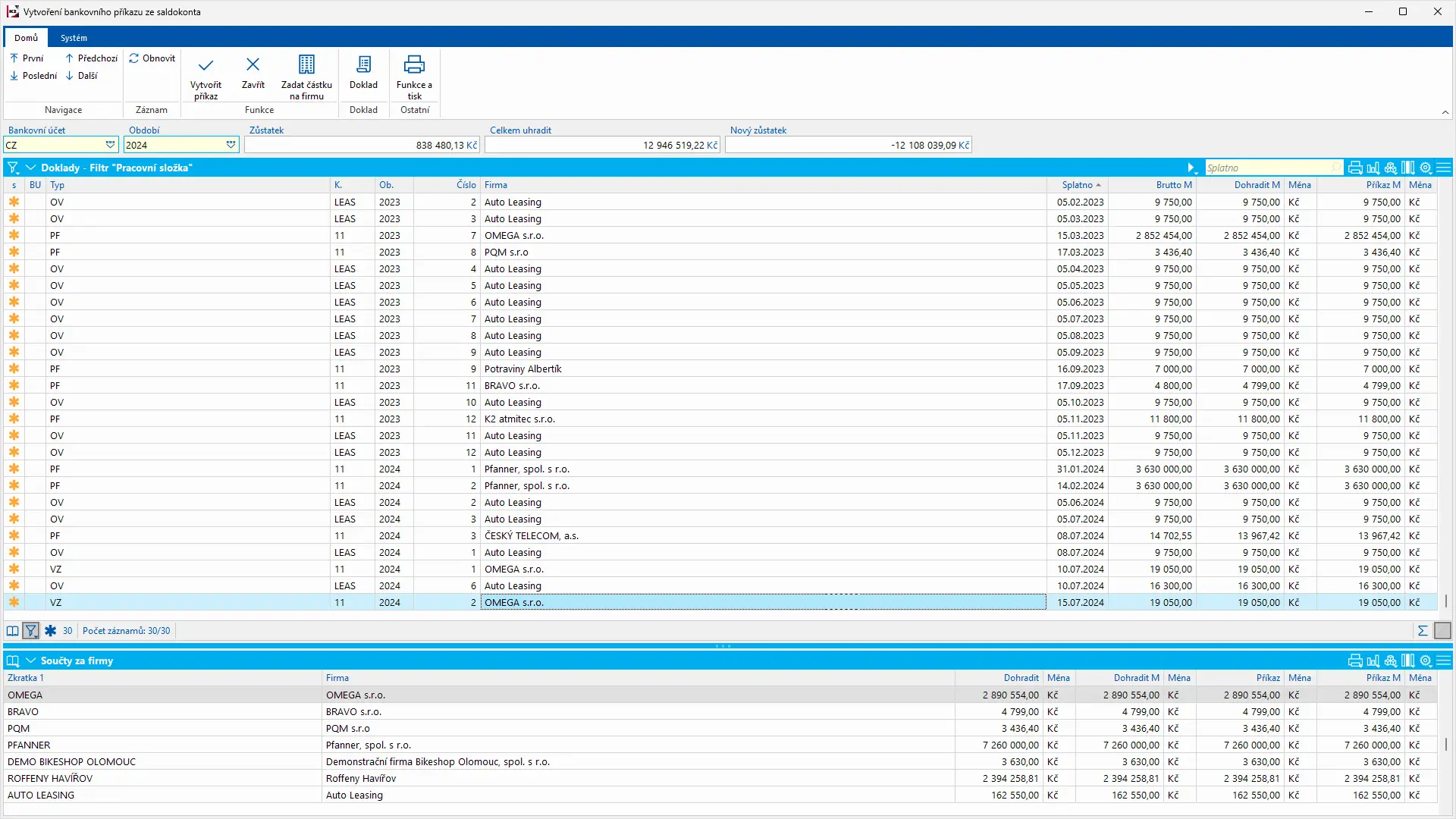

Payment orders

You can create payment orders not only from invoices, but also from the Balance Book, which displays unpaid purchase and sale documents. In addition, it is possible to automatically reduce the amount paid by the agreed percentage according to the terms of the discount. On payment orders, payments to the same account can be combined into a single amount, which reduces fees (especially for foreign payments). When importing a bank statement, such a payment is automatically assigned to individual invoices.

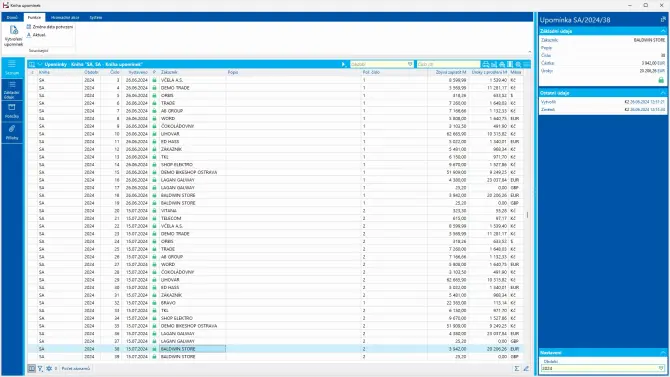

Debt collection

According to the specified criteria, the system can select unpaid invoices and create reminders for them. For each payment made, the number of days of delay is displayed and a partial penalty for late payment is calculated. Total penalties and penalties today are also calculated continuously, and these data can be used to automatically create penalty invoices.

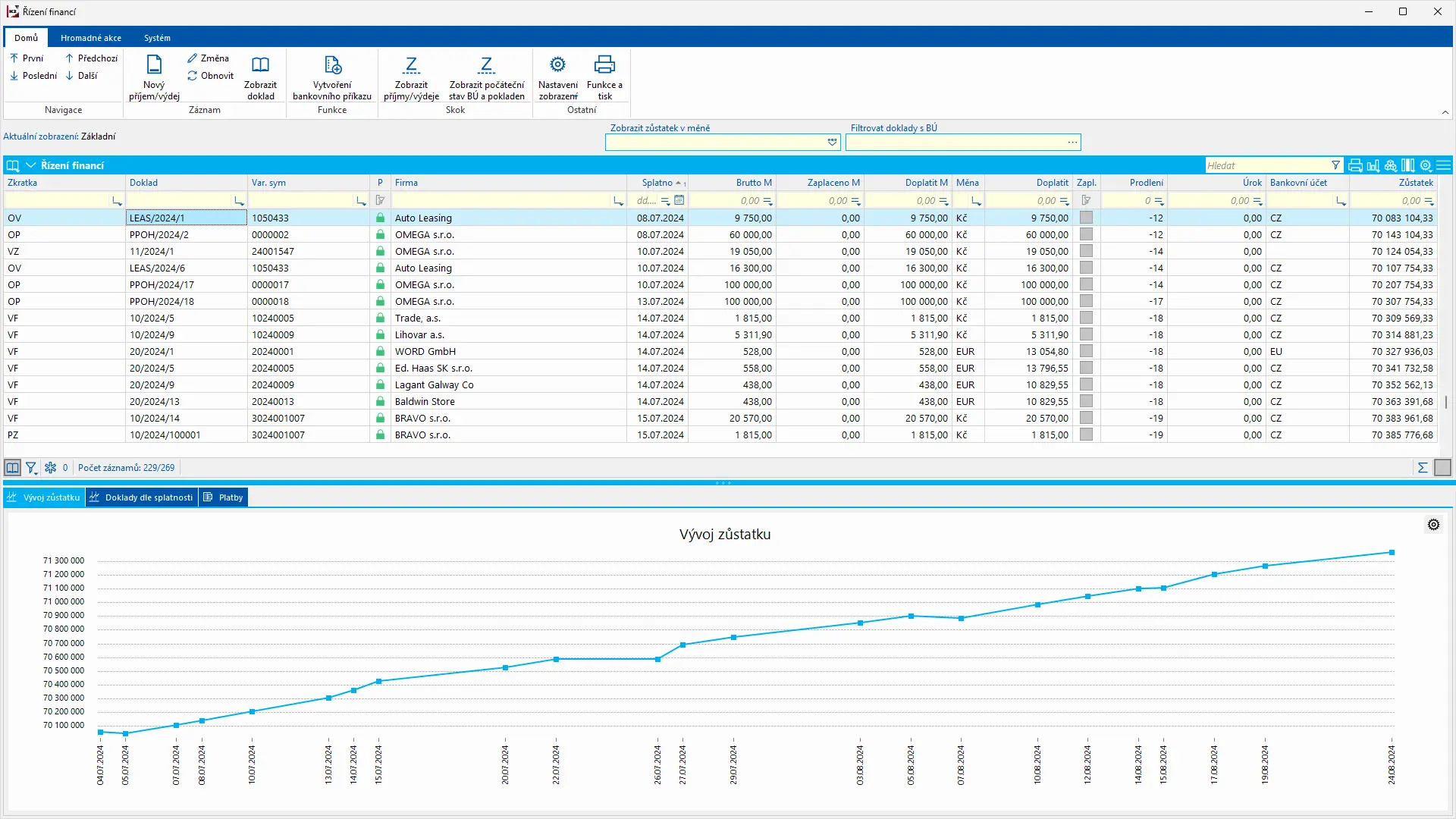

Financial management

The Financial Management module provides a comprehensive overview of expected income and expenses. It contains information from unpaid invoices, advances, other receivables and liabilities, salary liabilities as well as from uninvoiced unconfirmed orders and orders issued and uninvoiced contract items. The Financial Management module also includes planned income/expenses, which can be edited and entered directly in the module. On the basis of this information, the development of the current balance is displayed, also with regard to the state of funds in bank accounts and cash registers.

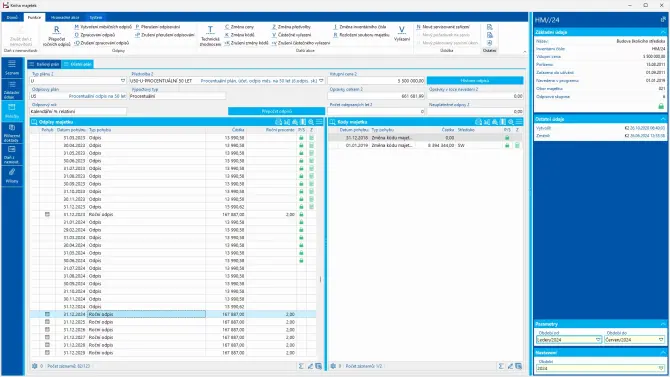

Management of all types of asset

The K2 information system manages all commonly used types of asset. You can use a selection of pre-set methods of asset depreciation, while the depreciation itself is solved in such a way as to satisfy the needs of Czech and Slovak legislation. Assets are registered and sorted using codes (e.g. location, cost center, order, article, clerk etc.). In IS K2, it is possible to register asset even before it is put into use. Functions for physical asset inventories are also available.

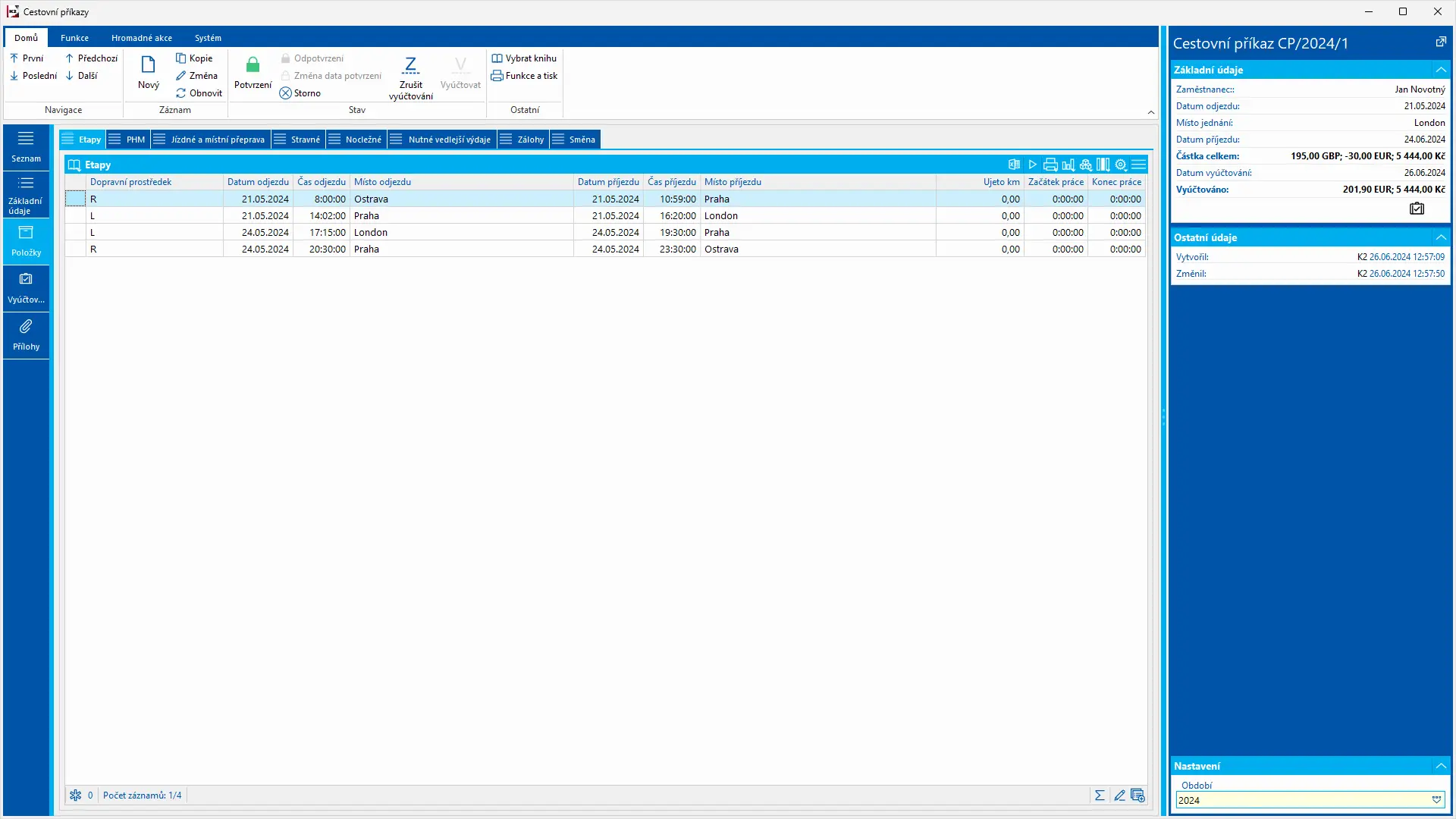

Traveling orders

Travel orders allow the recording and billing of domestic and foreign work trips. Billing can be done in cash, by transfer or in wages. Approval takes place electronically, e.g. by linking to a workflow.

Why manage accounting and finance with K2?

- You get automatic posting of documents

- You can correct documents in the open period

- You will be able to create your own economic analyzes and evaluations

- Effective debt collection

- You will start to manage your finances comprehensively

- Easier management of travel orders

- Connection to workflow is an advantage

Examples of use

Automation of accounting operations

Every business has a high volume of daily transactions that include sales, purchases and banking transactions. Using the Accounting and Finance module in the K2 system, a business can automate the recording of these transactions. The K2 system automatically assigns the correct accounting entries to each transaction, reducing the risk of human error and increasing the efficiency of the accounting process.

Creation of financial analyzes and reports

The K2 system allows companies to create detailed financial analyzes and reports. Businesses can analyze their financial statements, monitor the performance of individual divisions or product lines, and identify areas for improvement.

Management of receivables and payables

K2 enables the company to effectively manage its receivables and payables. The system monitors the maturity of invoices and automatically creates reminders for unpaid invoices. This helps keep cash flow under control and minimize the risk of late payments.